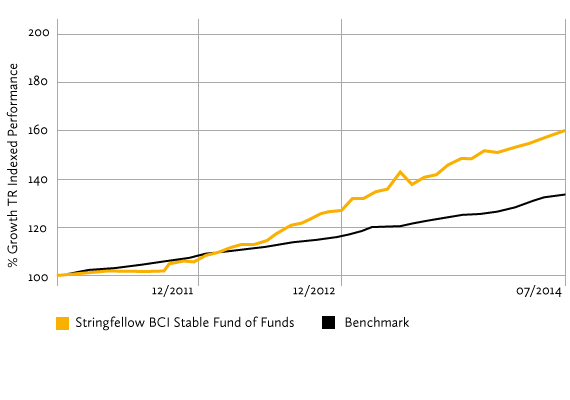

Stringfellow MET Stable Fund of Funds

Ranked SA’s No. 1 Stable FoF over the last 5 years.

Designed and managed to provide investors with moderate to high levels of income and stable long-term capital growth, Stringfellow Stable is ranked SA’s No. 2 stable fund of funds over the last three years, and No. 1 over the last five years. Globally, Stringfellow Stable currently ranks 65 out of 743.

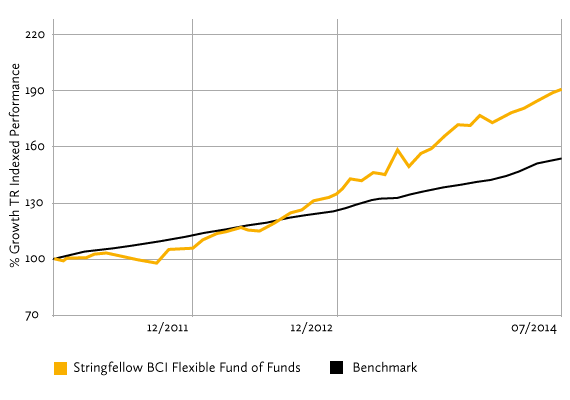

Stringfellow MET Flexible Fund of Funds

Ranked SA’s No. 8 Flexible FoF over the last 5 years.

Designed and managed to provide investors with a relatively high long-term total return, Stringfellow Flexible is ranked SA’s No. 8 flexible fund of funds over the last five years. Globally, Stringfellow Flexible currently ranks 38 out of 716.